Homeowners Insurance in and around Brinkley

A good neighbor helps you insure your home with State Farm.

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

Home Is Where Your Heart Is

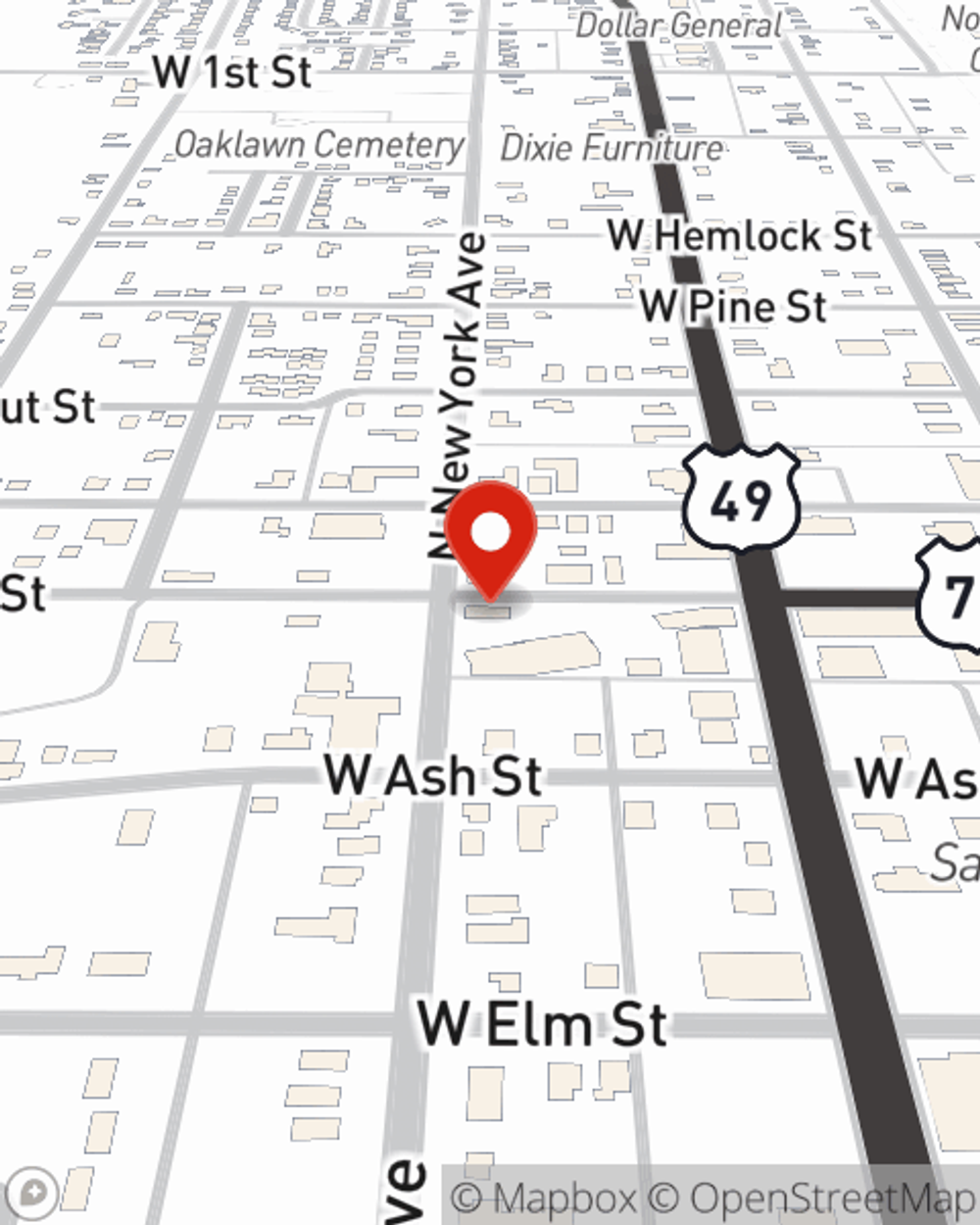

You have plenty of options when it comes to choosing a home insurance provider in Brinkley. Sorting through savings options and providers is a lot to deal with. But if you want surprisingly great priced homeowners insurance, choose State Farm. Your friends and neighbors in Brinkley enjoy unbelievable value and straightforward service by working with State Farm Agent Anna Grizzle. That’s because Anna Grizzle can walk you through the whole insurance process, step by step, to help ensure you have coverage for your home as well as sound equipment, cameras, videogame systems, linens, and more!

A good neighbor helps you insure your home with State Farm.

Give your home an extra layer of protection with State Farm home insurance.

Don't Sweat The Small Stuff, We've Got You Covered.

With this outstanding coverage, no wonder more homeowners pick State Farm as their home insurance company over any other insurer. Agent Anna Grizzle would love to help you find a policy that fits your needs, just contact them to get started.

There's nothing better than a clean house and coverage with State Farm that is value-driven and reliable. Make sure your belongings are protected by contacting Anna Grizzle today!

Have More Questions About Homeowners Insurance?

Call Anna at (870) 734-2770 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

How to keep birds away from your house

How to keep birds away from your house

If birds or geese are a problem in your yard, becoming a nuisance to you and your family, these deterrent tips may help you keep unfriendly fowl at bay.

Anna Grizzle

State Farm® Insurance AgentSimple Insights®

How to keep birds away from your house

How to keep birds away from your house

If birds or geese are a problem in your yard, becoming a nuisance to you and your family, these deterrent tips may help you keep unfriendly fowl at bay.